Why the rich are getting richer - Robert Kiyosaki

This is a quick note from the lesson of this book for my further reference.

- “The issue of wealth and income inequality is the great moral issue of our time.”

- Go to School, get a job, save money, get out of debt and invest for the long-term in the stock market is obsolete advise". because “Viruses can erase customer accounts without trace. Used offensively, these 3.viruses can create and uncontrolled flood of sell orders on widely held stocks such as Apple or Amazon.”

- “Savers are losers”, due to low interest rate.

- “Your House is not an asset”

- “Economics is not financial education”

- “The Rich do not work for money”

Nation always has been progressed through the following sequence

- From bondage to spritual faith

- From spritual faith to great courage

- From courage to liberty

- From liberty to abundance

- From abundance to selfishness

- From selfishness to apathy

- From apathy to dependence

- From dependency back to bondage once more

“Your financial IQ is your ability to solve financial problems.”

All millionaires are not created equal

- A million-dollar-a-year-job

- A millionaire sports star

- A millionaire movie star or rock star

- A millionaire entrepreneur

Financial Education

- Do you want to be an employee with a million-dollar salary?

- Do you want to be a net worth millionaire?

- Do you want to be a capital gains millionaire?

- Do you want to be a cash flow millionaire?

- Do you want to be a lucky millionaire by marrying a rich person, inheriting money, or winning the lottery?

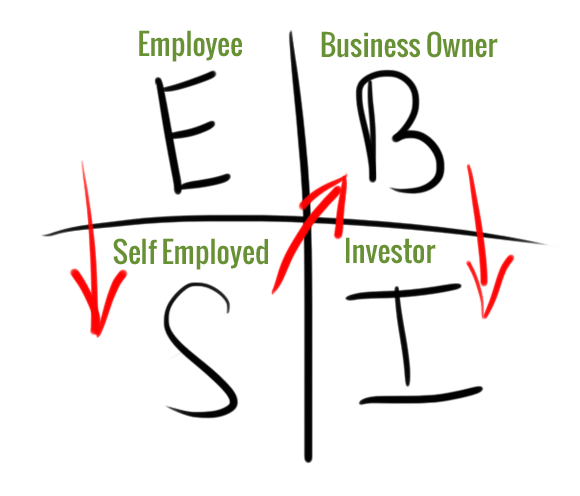

Most important - Cashflow Quadrant

- E - Employee (Pays 40% Tax)

- S - Small business owners or specialists, such as doctors or lawyers or self-employed including web designers (Pays 60% Tax)

- B - Big business, business with 500 employees or more. (Pays 20% Tax)

- I - Professional investors (Pays 0 % as Tax)

Poor Dad : “I am not interested in money”

Rich Dad : “If you are not interested in your money, someone else is”

Ignorance : Destitute of knowledge

Ignore : Refuse to take notice of

Petro dollars : a notional unit of currency earned by a country from the export of petroleum.

“Mistakes makes man richer”

The price of Financial Il-litracy

- Financial illiteracy immobilizes people.

- Financial illiteracy destroys self-esteem.

- Financial illiteracy causes people to be frustrated and upset.

- Financial illiterate people create fixed ideas.

- Financial illiterate people believe they are victims.

- Financial illiteracy causes blindness.

- Financial illiteracy causes poverty.

- Financially illiterate people make poor investors.

- Financially illiterate people make poor investors.

- Financially illiteracy causes poor judgment.

- Financial illiteracy causes a person to hate life.

- Financial illiteracy can lead to unethical actions.

- Financial illiteracy distorts reality.

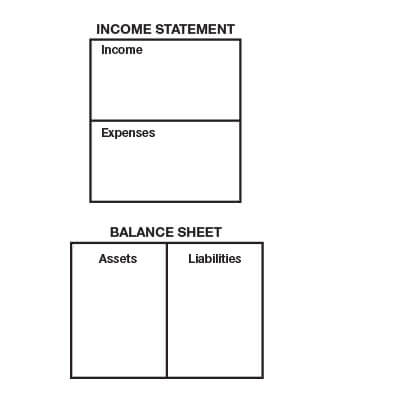

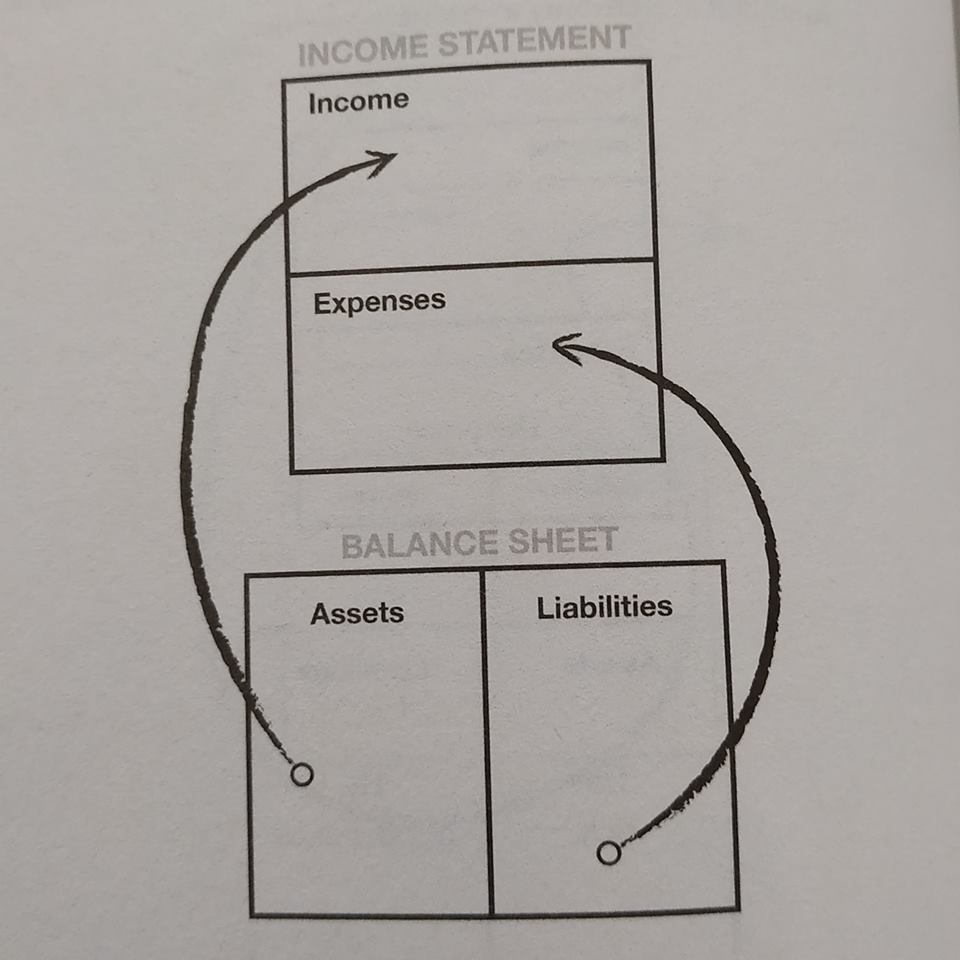

Income Statement and Balance Sheet

Six important Word of financial literacy

- Income

- Expense

- Assets

- Liabilities

- Cash

- Flow

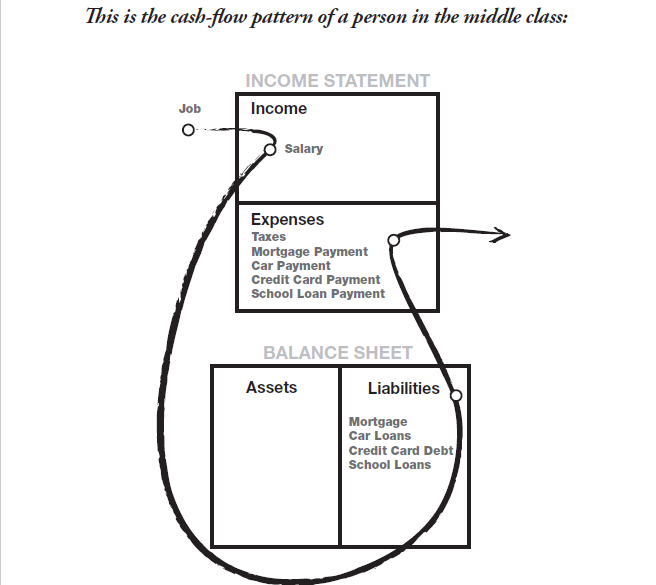

Cash flow of middle class

The tax code punishes those in the E and S quadrants and The tax code rewards those in the B and I quadrants.

Types of income

- Ordinary income - Job income

- Portfolio income - Also called capital gains, occurs when you buy low and sell high.

- Passive income - Cash flowing from an asset.

CASHFLOW Quadrant

- Mind

- Body

- Emotions

- Spirit

- Rules

“Have Plan B”, Always have multiple source of income. Don’t stay in the same job for too longer.

Three things required to learn

- A willingness to learn

- Choosing your teacher wisely

- Practice

Debt is money

It has no tax to be paid.